January 25, 2025

This month marks a historic turning point in financial innovation.

On January 3, 2009, a mysterious figure known as Satoshi Nakamoto mined the first block on the Bitcoin blockchain—the Genesis Block. Sixteen years later, Bitcoin is no longer a niche concept for tech enthusiasts but a global phenomenon central to discussions about money, freedom, sovereignty, and financial independence from the iron grip of the state.

As a consultancy focused on Bitcoin, macroeconomics, and sovereignty, I want to share my thoughts on the Genesis Block and its implications for the future. Perhaps this can provide valuable insights to companies and investment funds.

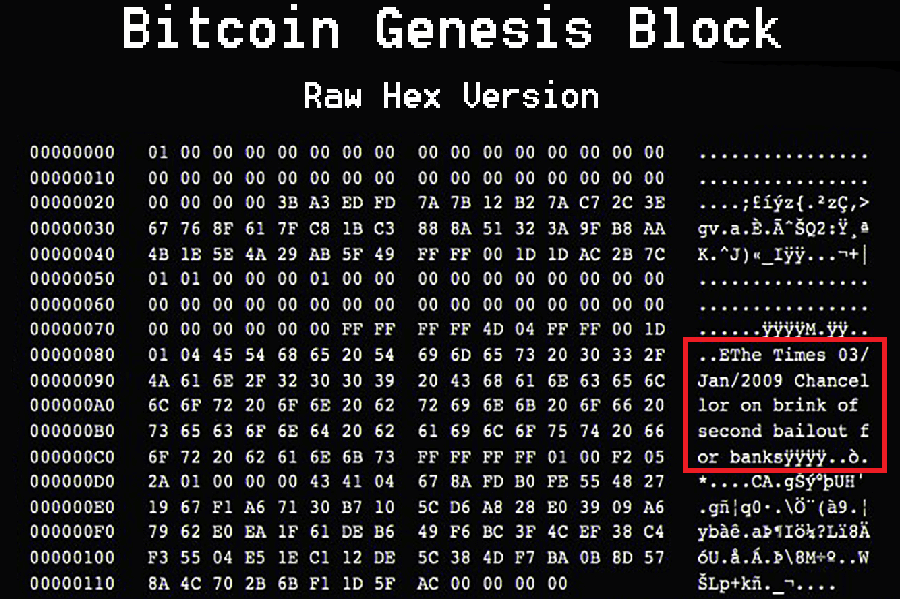

A message was encoded into the Genesis Block: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” This was not just a timestamp but a bold statement on the fragility of the traditional financial system. The 2008 financial crisis exposed the weaknesses of global banks and the dual role of central banks as both supervisors and rescuers. Bitcoin emerged as a response—a decentralized alternative free from central bank and government control.

Understanding Bitcoin’s origins is crucial for institutions, businesses, and investors. It wasn’t created as a speculative investment vehicle but as a technological solution to persistent issues such as inflation, financial instability, and endless money printing by central banks.

From an experimental project shared among cryptography enthusiasts and computer geeks in 2009, Bitcoin has grown into a recognized digital currency and investment instrument with a market value of over 13 trillion Danish kroner. Major companies such as MicroStrategy, Tesla, and Block have already added Bitcoin to their balance sheets, while financial giants such as BlackRock and Fidelity have launched products based on Bitcoin.

Rumors even suggest that some nation-states are considering building strategic reserves of Bitcoin, much like they have traditionally done with gold. These developments highlight Bitcoin’s growing recognition as a serious solution to inflation and uncertainty in a global economy marked by central bank monetary policy and geopolitical tensions.

Sixteen years after the first block on the blockchain, Bitcoin continues to fulfill its original promise of providing an alternative to the existing financial system. This milestone is more than just history for businesses and investment funds—it’s a call to action. The financial world is changing, and those who understand and adopt Bitcoin early will lead the next era of financial transformation.